SUSTAINING PORTFOLIO VALUE

We continually monitor our portfolio for any changes that could affect our clients, their industries and the real estate locations in which we have invested. We also regularly analyze our portfolio with a view toward optimizing its returns and enhancing its overall credit quality.

Active management of the portfolio is an essential component of our long-term strategy to maintain high occupancy, build enduring relationships with our clients and generate additional internal growth.

OUR GOALS

CURATE THE OPTIMAL PORTFOLIO

We strategically build the ideal mix of exposure to certain clients, industries, and markets through releasing vacant properties and selectively selling properties.

EXECUTE A CLIENT-CENTERED PROCESS

With over *#operating-history-years#* years of operational history, we understand our clients' needs and operational goals in order to execute a seamless lease transaction process. Our standardized lease process makes leasing from Realty Income simple and efficient.

RETAIN ASSET VALUE

We seek to maximize our asset-level returns on properties that are renewed, released or sold.

CREATIVELY ADD VALUE

By enhancing individual properties, pursuing alternative uses, and delivering ancillary revenue, we aim to create incremental value from the existing portfolio.

Active Asset Management Adds Value

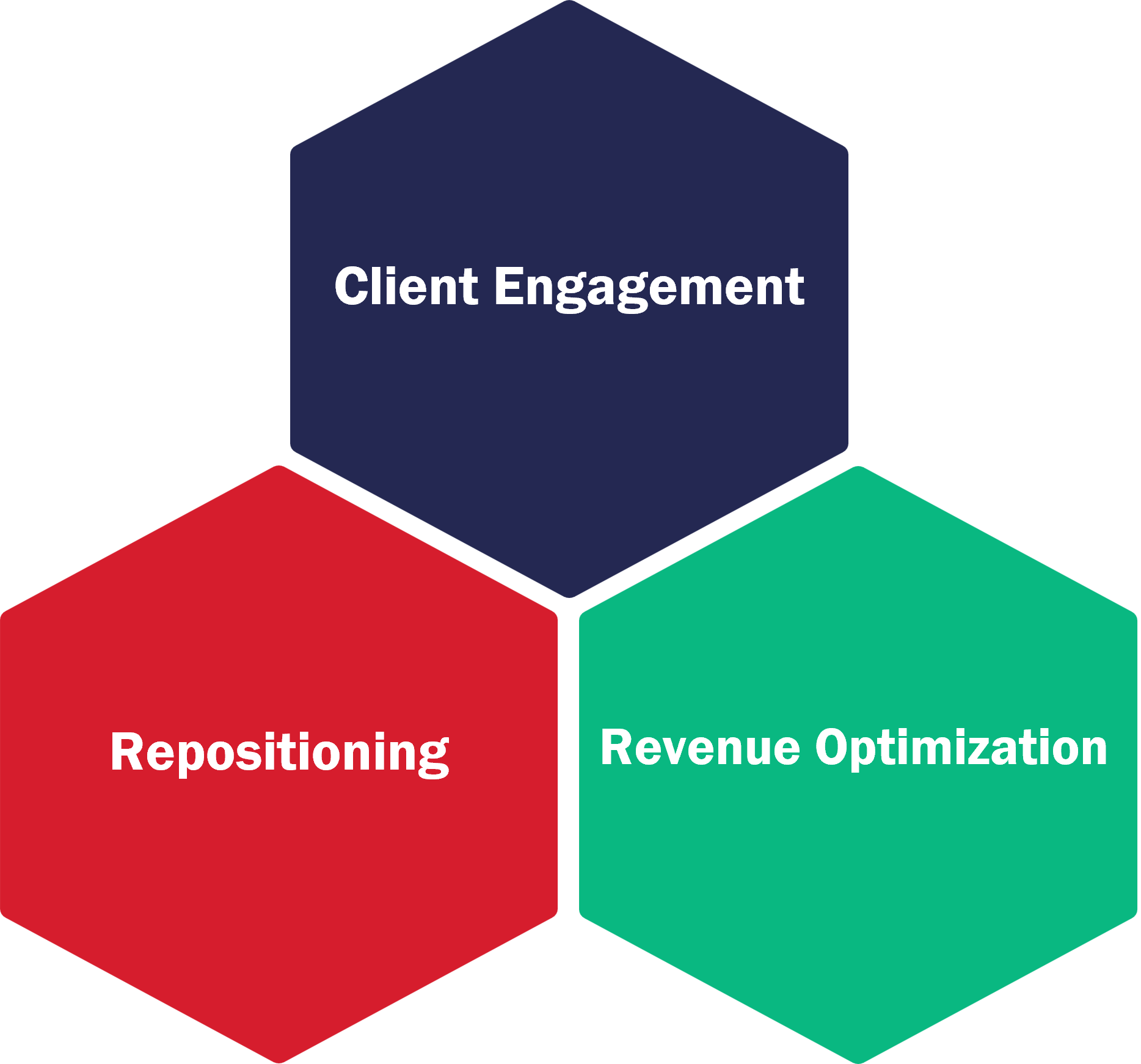

Realty Income's in-house asset management expertise helps drive value enhancement throughout its vast real estate portfolio by:

- Client Engagement: Fostering new and progressing existing long-term client relationships

- Repositioning: Seeking to enhance portfolio value through re-leasing and capital recycling efforts

- Revenue Optimization: Utilizing industry expertise to drive incremental and outsize rental revenues

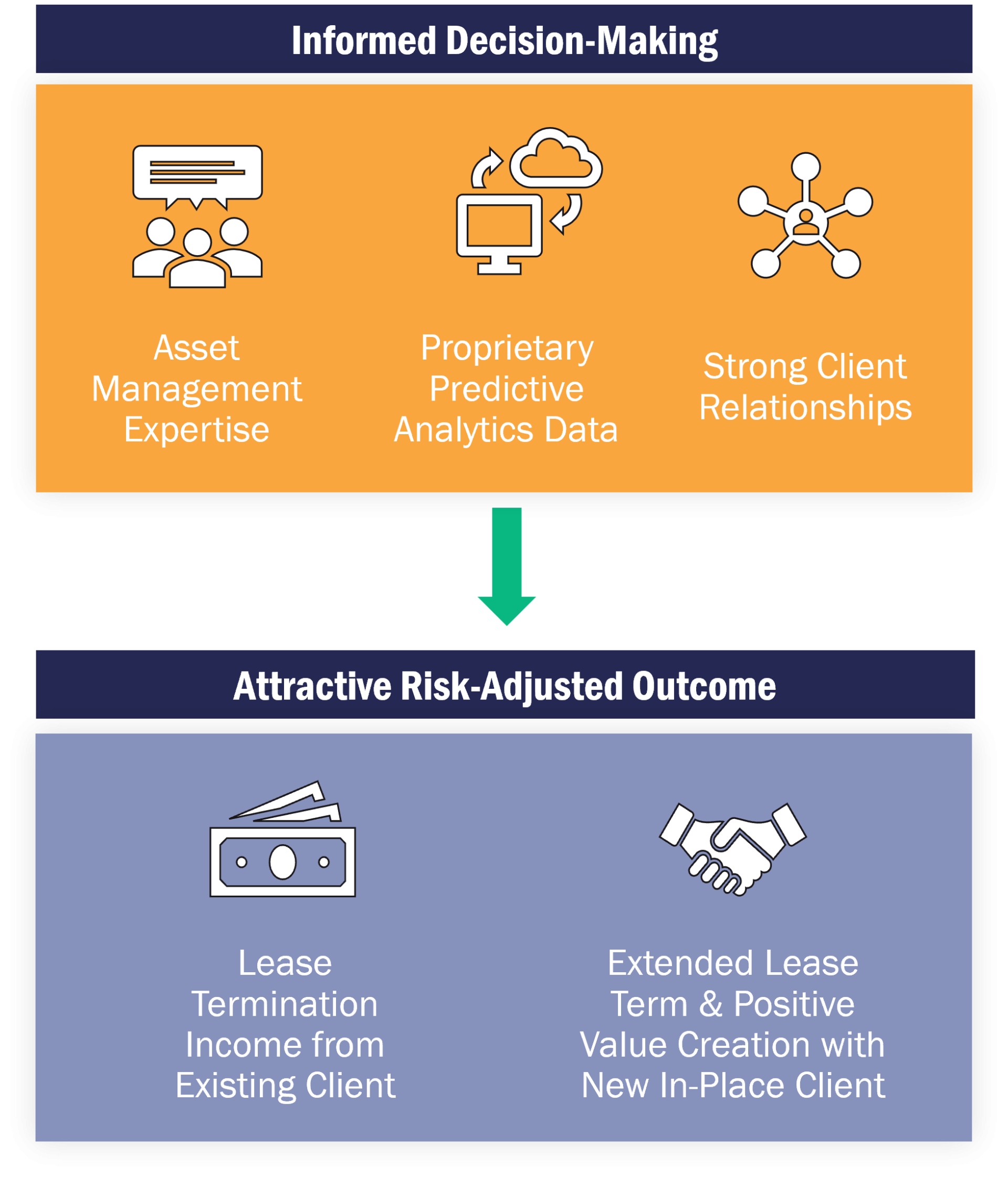

PROACTIVE LEASE RESOLUTIONS

Our asset management team employs our Predictive Analytics AI tools and models to selectively pursue early lease terminations ahead of potential unanticipated vacancies; generating incremental value by monetizing remaining lease terms, and coincidentally re-leasing and repositioning the assets—driving both unplanned additional rental revenues, as well as growing asset valuations. We proactively pursue these opportunities only when the lease termination income and new rental income with longer lease term offers what we believe will be a better economic outcome.

CLIENT SERVICES

Our property management and asset management teams partner with our clients and strategic vendors to generate ancillary revenue and operational savings throughout the portfolio through the following avenues:

EV Charging Stations

Telecom & 5G Capabilities

Solar Arrays

LED Lighting

And More

ASSET MANAGEMENT CONTACTS

Janeen Drakulich

Ross Edwards

Jeff Koerperick

Garret Pavelko

Matthew Landau